Listed companies analysis Ranking Industry ratios Statements. Bursa Malaysia Berhads operated at median current ratio of 12x from fiscal years ending December 2017 to 2021.

Corporate Pensions And Funding Ratios Institutional Blackrock

In other words Financial Ratios compare relationships.

. The NA ratio of Pan Malaysian Industries Bhd is significantly lower than the average of its sector Real Estate Holding Development. For example an Assets to Sales Ratio Total Assets Net Sales. Nine financial ratios measure seven variables which are firm visibility.

Original Landscape Welcome to Original Landscape. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others. The NA ratio of Pan Malaysian Industries Bhd is significantly lower than the median of its peer group.

The Industrial Production Index IPI increased 46 per cent in April 2022 as compared to the same month of the previous year. Designmethodologyapproach Data are. Industrial sector and to analyze the financial trend from year 2000 to 2008.

The industrys 3-year average PS ratio 30x is higher than the industrys current PS ratio of 26x. Dun Bradstreets Key Business Ratios provides online access to benchmarking data. 220 rows This ratio measures the companys income generating ability as compared to the revenue balance sheets assets equity and operating costs.

The industry is trading close to its 3-year average PS. League tables May 1st 2022. Where can i possibly find it.

According to these financial ratios Pan Malaysian Industries Bhds valuation is way below the market valuation of its peer group. Investors are pessimistic on the industry indicating that they anticipate long-term growth rates will be lower than they have historically. A ratio shows how many times the first number contains the second number.

Seventeen financial ratios were selected as measurement performance tools. 10 or 110 10 or 10. Bursa Malaysia Berhads latest twelve months current ratio is 11x.

According to these financial ratios Telekom Malaysia Bhds valuation is way below the market valuation of its peer group. Select Industry and search by SIC code 3411. Operating margin ratio Operating income Net sales.

The factor analysis is utilized to find. RMA provides balance sheet and income statement data and financial ratios compiled from financial statements of more than 240000 commercial borrowers classified into three income brackets in over 730 different industry categories. Financial ratiosand efficiency 117.

May 29 2021 by by. Ranked lists show the leading firms in diverse parts of the financial industry. The industry is trading at a PE ratio of 360x which is lower than its 3-year average PE of 903x.

EYs benchmarking analysis can provide insight into your companys performance by comparing financial and related data from similar organizations. The higher the ratio the better. That will bring up key financial information for major companies in the metal can industry.

This calculation is done by dividing the sales price of the last product manufactured by the total cost of production multiplied by the number of units produced. Revenue Growth - the rate of change in revenue compared to the previous years revenue performance. Gross margin ratio Gross profitNet sales.

Return on assets ratio the ROA also known as the return on total assets is used to determine the net income from total assets within a given time period. The failure rate of construction companies in Malaysia is high. This includes information from 185 industrial companies and fifteen financial ratios are selected for this study.

Average industry financial ratios for US. Or manually enter accounting data for industry benchmarking. The gross profit margin is calculated as a 100 sales price per unit.

Malaysia financial services subsectors. All Industries Measure of center. For three years were used as a comparison with the industry average.

Is significantly lower than the average of its sector Fixed Line Telecommunications. Nine financial ratios measure seven variables which are firm visibility tangibility working capital leverage liquidity productivity and profitabilityData are collected from 108 public listed companies in Malaysia. Index Of Industrial Production Malaysia April 2022.

Return on assets ratio Net income Total assets. By Emily Thornton on Nov 19. Malaysia financial services league tables.

Return on Assets Ratio Net income Average total assets. This paper examines the financial ratios that may have a significant effect on the efficiency in Malaysian listed companies. Bursa Malaysia Berhads current ratio for fiscal years ending December 2017 to 2021 averaged 12x.

XiamenUniversity-MalaysiaSepangMalaysiaand SanaaUniversitySanaaYemen Abstract Purpose This paper examines the financial ratios that may have a significant effect on the efficiency in Malaysian listed companies. Construction industry in Malaysia. Is significantly lower than the median of its peer group.

Looking back at the last five years Bursa. 2021 2020 2019 2018 2017 2016. Financial data for industrial companies are collected from Kuala Lumpur Stock Exchange KLSE.

The EVEBITDA NTM ratio of Telekom Malaysia Bhd. Explaining what the financial ratio mean on the factsheet. Nine financial ratios measure seven variables which are firm visibility tangibility working capital leverage liquidity productivity and profitability.

According to the Construction Industry Development Board Malaysia CIDB from. The revenue cost is the sum of all the costs incurred during the manufacturing of the product. It can reveal potential improvement opportunities in the size cost and efficiency of your finance function internal controls and working capital.

I just wanna know the industry average ratio of the return on investment in money market fund of the philippines. The industry is trading at a PE ratio of 252x which is lower than its 3-year average PE of 288x. Use the Company Dossier search.

The EVEBITDA NTM ratio of Telekom Malaysia Bhd. Asset management Banking Digital finance Financial markets and instruments Financial regulation Insurance Key forecasts Overview. Gross Margin - is a percentage based on a businesss total revenue minus their cost of goods sold all divided by the total sales revenue.

The expansion of IPI was contributed by the Manufacturing and Electricity sectors which recorded increases of 62 per cent and 15 per cent respectively. Industry average ratio in malaysia. Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1.

5000001000000 05 50.

Corporate Pensions And Funding Ratios Institutional Blackrock

Malaysia Bank Cost To Income Ratio Data Chart Theglobaleconomy Com

Descriptive Statistics Of Financial Ratios Used In The Research Download Table

Malaysia Stock Market Turnover Ratio Data Chart Theglobaleconomy Com

Malaysia Bank Cost To Income Ratio 2022 Data 2023 Forecast 1996 2020 Historical

Slowdown In Motor Insurance To Drag Down Malaysian General Insurers Growth In 2021 Says Globaldata Globaldata

Household Debt Versus Gdp Globally By Country 2020 Statista

Bursa Malaysia Pe Ratio Energy Economic Indicators Ceic

Bursa Malaysia Pe Ratio Ftse Composite Index Economic Indicators Ceic

Malaysia Average Salary By Age Statista

Pdf Financial Ratios And Efficiency In Malaysian Listed Companies

Malaysia Gross Domestic Product Gdp Growth Rate 2027 Statista

Malaysia Bank Cost To Income Ratio Data Chart Theglobaleconomy Com

Malaysia Debt Service Ratio Private Non Financial Sector 1999 2022 Ceic Data

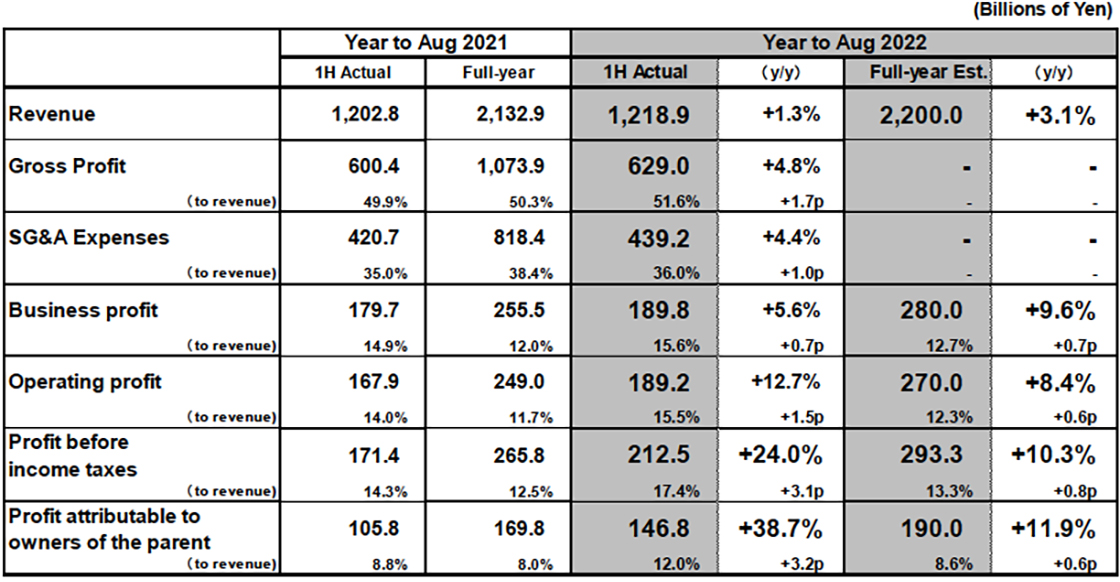

Results Summary Fast Retailing Co Ltd

Industry Average Financial Ratios For Transportation Storage For Download Scientific Diagram

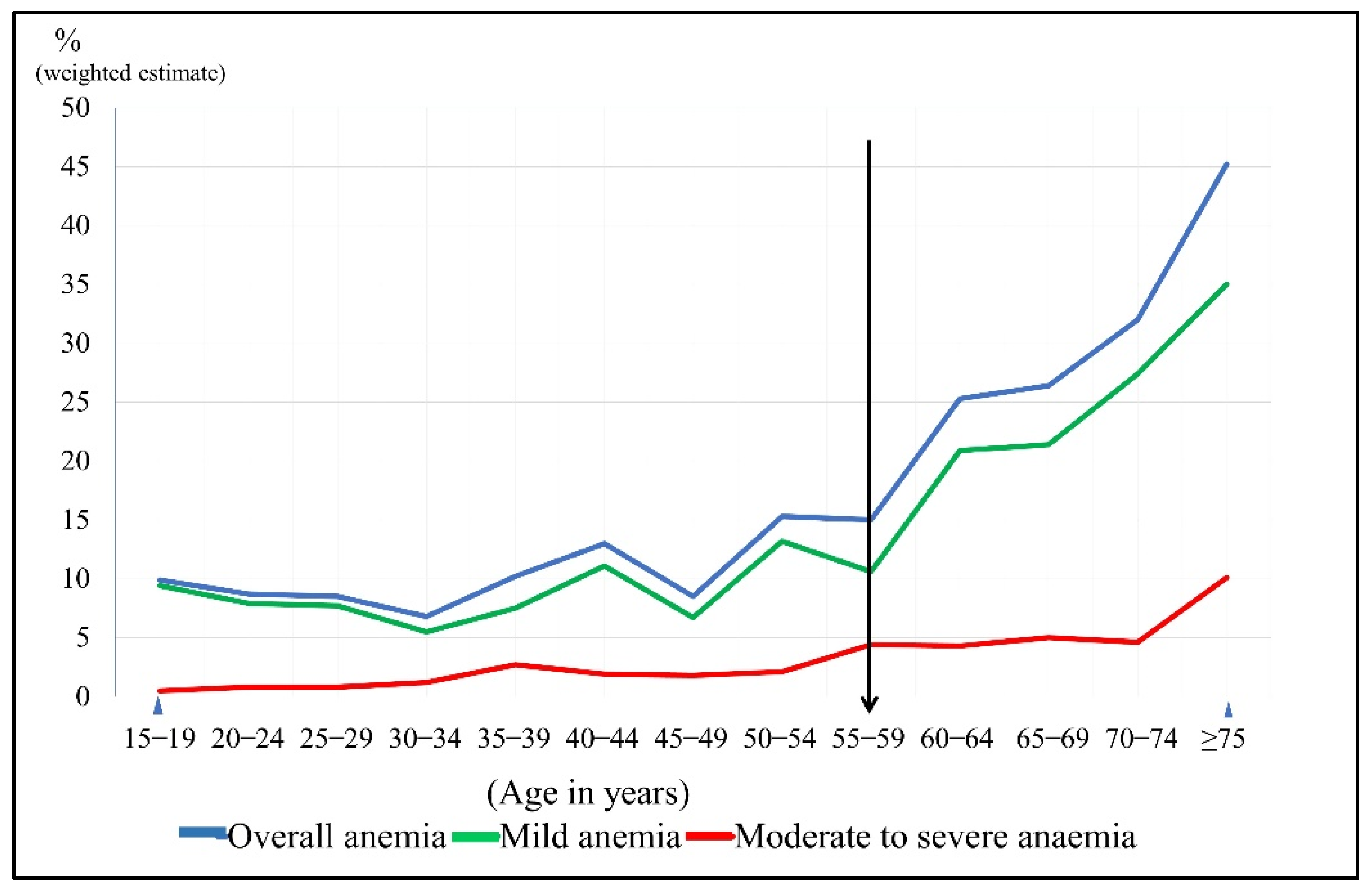

Ijerph Free Full Text Anemia Among Men In Malaysia A Population Based Survey In 2019 Html